It’s a common theme in about every boardroom: the need to innovate. And not just a bit of sustaining innovation, no: the need for really disruptive innovation. Because that’s where the future is. Or at least that’s what we’ve been told when looking back and seeing disruptions from the past. But is it really like that? Does disruptive innovation pay off? Or to put it in another way: when does it pay off? Let’s take a look at two examples.

CONTENTS: Alphabet, the other bets | Tesla Inc | Why is this important?

Which are the most innovative companies at this moment, the companies that are on the verge of disrupting their industry? Chances are that you are thinking about Google (or to be correct: Alphabet, the holding company above Google) and Tesla Inc. Google/Alphabet has a large number of potentially disruptive projects: from self-driving cars to very specific healthcare challenges. And Tesla is all about disruption.

But let’s take a look at the financial side of it, both Google/Alphabet and Tesla are getting lots of media attention, and the impression is that they are the future. But what do their financial statements tell us?

Alphabet, the other bets

In its financials, Alphabet makes a distinction between everything that is related to Google (including YouTube) and the ‘other bets’. The biggest contributors to those ‘other bets’ are Nest (founded 2010), Fiber (founded 2010) and Verily (successor to Google Life Sciences). The annual reports from Alphabet show the following figures:

| Revenue (in million US $) | |||

| 2014 | 2015 | 2016 | |

| Google segment | 65.674 | 74.544 | 89.463 |

| Other bets | 327 | 445 | 809 |

| Consolidated revenues | 66.001 | 74.989 | 90.272 |

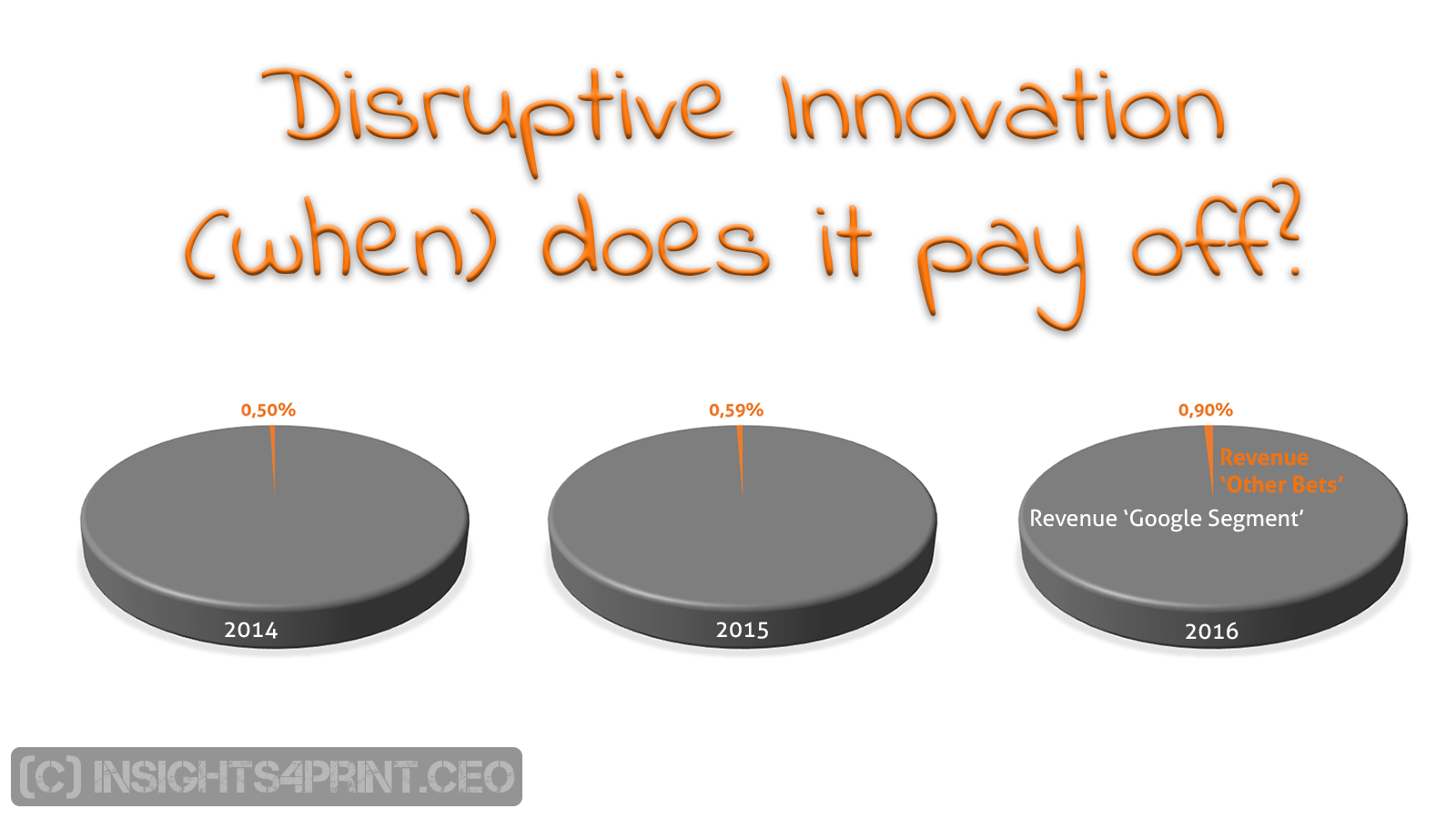

That 0,8 billion US $ revenue (2016) from innovative projects isn’t bad, unless you put it in a percentage of the turnover: not even 1%… And that might be the figure that is shown in boardrooms. And a figure that might kill innovation projects.

| Revenue as % of total | |||

| 2014 | 2015 | 2016 | |

| Google segment | 99,50% | 99,41% | 99,10% |

| Other bets | 0,50% | 0,59% | 0,90% |

Also important to note is the growth of those other best: that was 82% year over year, when comparing 2016 to 2015. That’s a figure that might please the board.

Alphabet has a steady source of income, it is very profitable. So you could say it can afford to invest in those ‘other bets’, to prepare for the future.

Tesla Inc.

When looking at the financials of Tesla Inc, the situation is different. Tesla is not profitable at this moment. The company was founded in 2003, almost 15 years ago and the first product, the ‘Roadster’, was launched in February 2008, almost 10 years ago. And although Tesla gets lots of attention and is praised for its products, it’s still losing money.

The oldest financial figures I found, are from 2010. When looking at Revenue, R&D costs and eventually the net income/loss, we see the following:

| In million US $ | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| Revenu | 116,74 | 204,24 | 413,25 | 2013,49 | 3198,35 | 4046,02 | 7000,13 |

| R&D | 92,99 | 208,98 | 273,97 | 231,97 | 464,70 | 717,90 | 834,40 |

| Net income/loss | -154,32 | -254,41 | -396,21 | -74,01 | -294,04 | -888,66 | -773,04 |

So while Alphabet has got its own means to finance the other bets, Tesla has to reach out to outside sources. The big question, in that case, is always: how long will these investors allow the company to make a loss.

Compared to traditional car makers, the turnover of Tesla is also quite limited. Ford: 151,8 billion US $; General Motors: 166,83 billion US $; Volkswagen group: 217,2 billion €; Toyota: 27.597,59 billion Yen (converted: 246,85 billion US $ or 206,47 billion €). According to this article on Wikipedia electric vehicles made up 0,85% of all new car sales in 2016… And that’s the figure for all electric vehicles, not just Tesla.

And then we get to the question of this blog post: (when) does disruptive innovation pay off? The short answer: if you’re lucky after many, many years. So, if you are developing a disruptive product that customers will be eager to purchase at the price that you will charge them, perseverance might be the key. To quote Greg Satell: “The Next Big Thing is probably 29 years old”.

I do have to add one note when it comes to Tesla Inc and electric vehicles: it will happen. And there is one very important reason why electric vehicles will be the future: government interference. Already in some countries, cars running on fossil fuels can’t be sold anymore after a certain date. A political decision that will create a huge market force towards electric vehicles. But this is exceptional: in most cases, disruptive innovations have to make it on their own.

Why is this important?

Innovation and the pace of innovation can be a point of discussion – and even disagreement – in the boardroom. The pace is often much slower than board members would like to see. That is what I tried to prove in this blog post: even the biggest innovators need time to get to that disruptive innovation. And even then, it is only a small percentage of the total turnover. Keep this in mind when discussing innovation with board members, with shareholders. Google/Alphabet is a nice example you can use in this kind of discussions.

PS: this article provides a nice overview of all the Alphabet companies, the other bets or sometimes called the ‘moonshots’. You can check the financials of Alphabet on this page. And for more information on Tesla, you can check this one. For an interesting analysis, I can recommend you this article by Forbes.

If you need help with setting up innovation teams, innovation projects, I am offering workshops and in company trainings on this! With a structured, simple and clear approach innovation becomes feasible for every company. The Innovation.Menu is a cooperation of insights4print.ceo and Yiist.com. Reach out if you would like to give your innovation a boast!

Be the first to comment